Ecommerce, SEO

The Four Pillars Of Ecommerce SEO

September 2, 2020

If you follow these four steps, you’ll see better sales and profits in no time.

Learn More

Loss aversion marketing: have you ever heard the phrase: “Play to win, don’t play not to lose.”? It’s a simple concept that seems to work pretty well for most successful people: staying focused on the positive is a great strategy for long term success. But most people don’t walk around thinking like that most of the time.

All people have primal instincts to avoid losing valuable resources, as in ancient times it could have dire consequences. It was simply a matter of survival for our ancestors. In today’s world, a tiger isn’t going to leap out from aisle 5 and eat you because you picked the wrong flavor of fruit juice at the grocery store, but our brains still assign just as much importance to daily decisions as they did thousands of years ago, even if most of them don’t result in life or death.

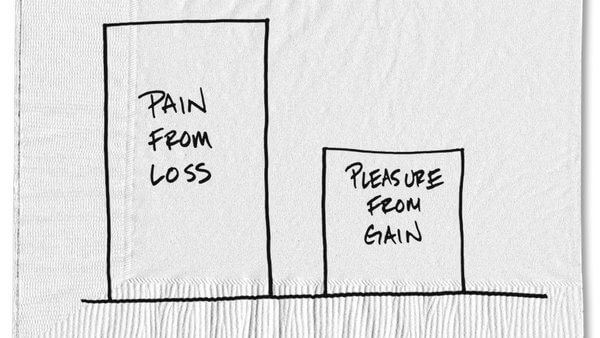

So when planning your marketing, it’s important to understand that people are naturally hardwired to respond more strongly to negative effects. In other words, they care more about not losing than they do about winning – a phenomenon that’s called loss aversion.

And because loss aversion is a such a powerful and hardwired psychological force, you can use it to great effect in your business, brand, and all areas of your life. Whether you’re looking to increase subscribers, sales, or anything inbetween, you need to know how loss aversion works on a deeper level and how to leverage it.

Many psychological studies have confirmed that loss aversion is twice as powerful as the prospect of winning. Think about that for a moment. If you have $100, it hurts twice as bad to lose that than it does to gain an additional $100, even though the same net change in value is occurring. It’s the reason someone gambling at a casino will spend all night trying to make back the $50 they lost rather than think of better ways to recoup their losses (like putting a few extra hours in at work the following week).

Loss aversion is largely responsible for risk aversion: the avoidance of taking risks. And in marketing, you must position your product as the superior choice (least risky) in order to move your prospect to taking action. Therefore, paint your competitors as the riskier option. For example, say: “Don’t waste $100 a month with ABC Energy Company, switch to XYZ Energy Company instead.”

The same concept can be used throughout your marketing. Tell your prospects that they risk losing sales, customers, viewership, money, and more when they don’t use your product.

Have you ever watched an adult give a seemingly meaningless object to a little kid in front of other kids? The kids all of the sudden want, need, obsess, over the object – even if it is just a piece of lint from the seat cushions. The child who originally received the object will protect it fiercely, often resorting to violence if necessary. This is because they have been “endowed” with this new object.

The endowment effect means that people value something more once they own it that before they own it. This applies to physical products, virtual products, flattering nicknames, and services alike. And, you guessed it, the power of endowment stems directly from loss aversion. To get better results in your marketing, always “assign ownership” of your products and services to your target market. They will feel a tighter bond with your brand as a result. Because let’s face it: deep down, we all harness an inner child like the one mentioned in the example above.

To start seeing marketing results with this concept, change the language you use. Always say “your product” rather than “the product” in your copywriting (including videos, images, and audio).

For example, in a marketing email, say: “Click here now to gain access to your free trial for 10 days.” instead of “Click here now to gain access to the free trial for 10 days.”

Do this before, during, and after they become a customer in order to assign ownership and reinforce the endowment effect (and thus loss aversion) in full force. It may seem subtle, but it makes a big difference.

Another way is to run a free trial or give out samples of your product. It allows your prospect to build a relationship with you and the solution you’re offering. Once it becomes part of their everyday life, they are much less likely to leave you. But speaking of customer retention, there is another powerful way to use loss aversion in your marketing:

Businesses love to reward their customers. This is great in theory, but it turns out that a better way to keep customers on board is to go another route. This is especially true in price changes. A research experiment on the effects of loss aversion in marketing was done with an insurance company. They wanted to see how customers reacted to changes in their insurance policies. Group A was presented with options for decreasing their current rate (gaining more money in their pocket).

But with Group B, the insurance company framed the price change as a loss, explaining how their rates would go up (thus they risked losing money out of their pocket) if they didn’t take certain actions. The same amount of net price change was used with groups, but the study found that the price increase was 200% as effective as a price decrease in preventing customers from switching to other insurance providers.

How often do you get to leverage such easy-to-use marketing tricks to reduce customer churn rates by 200% in your business? And who would have thought that focusing on losing would result in you winning over more prospects? But the research is out, and the conclusion is clear. By endowing your prospects with your product and framing certain choices as potential losses, you can enjoy more success in your marketing, business, and life. That’s the power of loss aversion.

If you’ve enjoyed this article and would like to work with us in the future, drop me a line at [email protected].

Ecommerce, SEO

If you follow these four steps, you’ll see better sales and profits in no time.

Learn More

Business, How to Guides

As the conclusion of a marketing job interview approaches, the interviewer often asks, "Do you have any questions for us?" This pivotal moment offers a golden opportunity for you, the interviewee, to showcase your genuine interest, understanding, and eagerness to excel in the role. Here are 10 questions to get you started.

Learn More

Marketing, PPC, Strategy

Understanding the ROI of your digital marketing endeavours is crucial for campaign success – here’s how to measure and analyse it, writes JASON LE. In the dynamic and fiercely competitive business landscape of today, digital marketing has emerged as an indispensable tool for organisations seeking to establish meaningful connections with their target audience and drive […]

Learn More