Marketing, Technology

Augmented Reality in Marketing

March 11, 2018

I recently chatted to the team at Realar about augmented reality in marketing was positioned.

Learn More

So thanks to everyone who read and shared my original post, Bitcoin for Beginners. Considering a normal post for me gets about 10 views and that one got 200, I’d consider that ‘going viral’. Winning.

As promised, this is the follow-up to that article, in which I’m going to focus on two things. One, I’m going to explain the difference in different cryptocurrencies and two, I’m going to (try and) explain what an ICO – an Initial Coin Offering – is.

CAUTION: once again, I have dumbed down a fair bit of this. Partially, so you can understand it. But mainly so I can understand it. If you think I have over-dumbed it to the point where I’ve got some of it wrong, by all means let me know. I’m not precious.

Now as I write this, I have been using an app on my phone called ‘Coin Stats‘ that allows for a real-time view of multiple markets where you can buy and sell cryptocurrency. It basically averages out all the markets and gives you a general trend as to how they’re moving, as well as the total Market Cap of all the coins (the total value of all the coins if you sold them all tomorrow).

That Market Cap is a little shy of $800 trillion.

(I edited this post two days later and the market cap of all the coins now sits at $726 trillion. Just a casual $74trillion of value lost in two days. No biggie.)

Now that number is only a little more ridiculous than the number of coins listed on Coin Stats – 1,380. Yes, there are 1,380 different cryptocurrencies available for you to buy today. And that number is increasing every day.

And when we talk about the one of the perceived values of Bitcoin being its scarcity (in that only 21million can exist), that seems strange when it has 1,379 sisters and brothers. And when anyone can create a currency tomorrow.

To explain that, we’ll run through a number of different cryptocurrencies in attempt to demonstrate how each one is (relatively) unique. Just remember, essentially a cryptocurrency is a unique bit of code, so if you’re familiar with thinking about it as a coin, try and think about it more as a ‘token’.

We went through Bitcoin in the last blog but some additional top line comments to help understand it further in context with the other coins.

Whilst the idea of an electronic cash system (originally labelled b-money, and then later ‘bit gold’) has been about since 1998, Bitcoin came into existence in 2009. This makes it the oldest of the cryptocurrencies. And really, the majority of coins that came after are similar to, or derived from, Bitcoin. It’s like the Adam and Eve of cryptocurrency. It still has varying legal status around the world – in fact in the US, Bitcoin is deemed as property for tax purposes.

So whilst Bitcoin is built on blockchain technology, many coins are built on the concept of Bitcoin. Subsequently, all the other coins are often referred to as ‘altcoins’.

Litecoin has been referred to ‘the silver to Bitcoin’s gold’ and was created not long after Bitcoin in October 2011. Although, two years in this sort of space is probably a long time.

Whilst Bitcoin was an anonymous creation, everyone knows Litecoin’s creator – a former Google employee called Charlie Lee. It is a variation on the Bitcoin client and differs in that the time taking to generate a block is faster (Litecoin is 2.5 minutes, Bitcoin is 10 minutes), a maximum number of coins that can be created and a few other differences in the security protocols.

What makes it more attractive? Well, in short, Litecoin is much easier to scale than Bitcoin which means it’s much easier to use for payments. That was Charlie Lee’s reason for creating it. A Litecoin transaction takes about two minutes, compared to Bitcoin’s current 300 minutes.

However, late December 2017, Charlie sold his entire stake in Litecoin. Make of that what you will. He has claimed it’s to eliminate any conflicts of interest. But it’s not done much for the Litecoin price in the short term.

Okay. Here’s where it starts getting a bit more technical. The token name is actually called Ether, and the company that created it is called Ethereum. But everyone uses both names for both. Confused yet?

Whilst you can buy and sell Ethereum like you can do Bitcoin, and it is also built on blockchain technology, it has a different use case – smart contracts.

Here’s how it works. If you’re using paper contracts, they’re prone to errors and changes and frequently they’d need lawyer in the middle to make sure everything is right. A smart contract skips a lot of those issues. Once all aspects of the contract have been fulfilled, the deal is executed.

The opportunity to streamline anything from buying a house to major global finance deals is massive and people like Microsoft and JPMorgan are developing uses for the Ethereum blockchain.

So why is it a currency? Well, to develop on it, or to transact on this chain, you need to buy the tokens. Simple as that. So if you own the tokens, someone is going to (maybe, probably, eventually) want to buy it off you. And, like Bitcoin, there is a limited amount of Ethereum that can ever be created – allegedly 100 million.

Remember those problems we have with Bitcoin? It’s slow to transact. The block size is small. And so on. Well, after a ‘hard fork’ (we’ll explain another time) back in July 2017, a new version of Bitcoin was created. That version was called Bitcoin Cash.

Yes, it’s faster, and yes, a lot of the Bitcoin purists hark on about Bitcoin Cash being the ‘real’ Bitcoin. But, well, its adoption is slow comparison to Bitcoin and it’s price, despite a leap in December 2017 when Coinbase (one of the biggest trading platforms in the world) decided to start supporting it, it’s not done what everyone thought it might.

Ripple – first introduced back in 2012 – is one of the currencies that gets a few people excited. Why? Well, a Ripple is a global payment system and a Ripple transaction can be settled in four seconds. And it’s target market is major financial institutions who need to move large amounts of cash around the world quickly. And who don’t want to pay a lot of fees.

You know the current Swift system you might have used to send money overseas? Well, it’s meant to replace that. And given that’s been in place since 1973, it’s about time.

Another exciting feature is it can allow the trade of two different asset classes – let’s say you wanted to swap gold bars for cows. Well as long as there’s an intermediary willing to facilitate that transaction, you can turn transact through the Ripple network.

People like American Express, UBS and Santander are playing in the Ripple space and at the moment it’s one of the cheapest currencies to get involved in, with a single unit costing AUD$1.50 at the time of writing this.

The downside? Well – ‘banks’. Decentralised currency is about sticking it to the banks (amongst other things) and here is a currency designed for the banks. So, yeah. There’s that.

Oh and yes, there number of coins is limited to 100 billion. That’s billion with a B. Compared to Bitcoin’s 21 million and Ethereum’s 100 million. So scarcity is hardly an issue here.

And here’s where it gets more complicated still. IOTA isn’t built on blockchain technology. It’s built on something called The Tangle.

No, you haven’t just walked into The Matrix or some other such sci-fi film.

Very quickly, the Tangle gets rid of the miner’s doing the proof-of-work – the sender does the work instead. This makes the system fully-decentralised as there’s no-one in the middle enabling the whole thing to work. This means that the more users that use the system, the faster it gets.

IOTA has been about since 2015 and is designed for ‘fee-less microtransactions for the Internet of Things’. So basically it’s been created to help your fridge talk to other fridges.

Okay, that’s being facetious. Fridges don’t need to send a lot of data to each other – a real-time update of how much milk you have left isn’t important data to anyone except perhaps your cat.

But things like self-driving cars will do in the next 5 to 10 years when the send real-time data to each other about traffic conditions, dangerous problems they’ve just overcome and so on. That’s where coins like IOTA (and a competitor token called Streamr) come in.

IOTA is a bit harder to buy too. But you can get it on CoinSpot.

Yes. It’s exactly what it sounds like. I added this one in to demonstrate the (current) futility of many of the coins.

Currently you can’t actually spend it anywhere. Hence why it hasn’t traded at all in the last 24 hours and has a value of $0.0002139. Might be worth a $1 investment and you never know, you could be living like a king the next time you’re in Vegas.

I see Dash being mentioned a lot. And NEM. And Monero. You’ll have to do your own research on those. Message me via [email protected] if you have any other burning hot recommendations – I’m happy to consider adding them to the list here.

As I said in the last post, this is NOT a financial advice column. Far from it. But here are my thoughts for what they’re worth.

Spend ten minutes on LinkedIn or Twitter and you’ll get about 20 different recommendations. Ignore them unless they’ve been in the crypto game for a long time (see my previous blog for a couple of good recommendations).

Whatever you do, do not listen to advice from established financial professionals or bankers who have no crypto experience. They’re out to protect their own market space.

Want to get rich quick? It’s as easy as creating your own coin. Let’s use burritos as an example. You all know how much I love burritos.

If this sounds – and pardon my language here – as ‘dodgy as fuck’ it’s because sometimes it is. It’s unregulated and there has been a few scams with people running off with a lot of money. Like Confido.

If you’re thinking of investing in an ICO then for GOD’S SAKE do your research. And think about the value of the new coin post-launch. You don’t want to pay the equivalent of $100 for a coin and then find it drops to $1 after launch. That would be one expensive burrito.

Whilst the technology behind Bitcoin has been around since 2009, it’s only just starting to receive mainstream attention, and the bigger companies around the world are starting to invest R&D money in blockchain uses. Israel and Dubai are looking at their own cryptocurrencies (as are many others) and what sits at 1,380 is probably going to rise a lot higher in 2018 and beyond.

What could be the dominate cryptocurrency in the marketplace might not be something that even exists yet, so if you want to keep ahead on ICOs and new cryptocurrencies there are plenty of good websites doing a good job of tracking them.

Photo by Markus Spiske on Unsplash

Photo by Samuele Errico Piccarini on Unsplash

Marketing, Technology

I recently chatted to the team at Realar about augmented reality in marketing was positioned.

Learn More

Business

Simon’s presentation at Brisbane Business Hub on behalf of CCIQ is available to review at the following link here. It runs through two key areas: some marketing theory and then 10 ideas about how to improve your own business marketing.

Learn More

Marketing

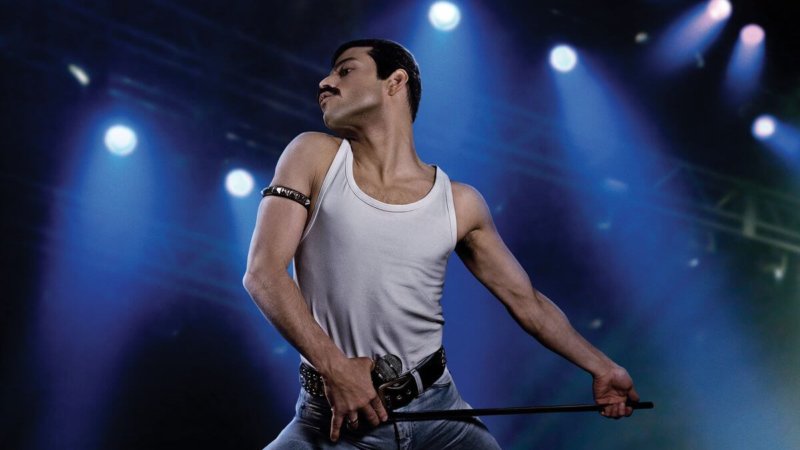

I've been a Queen fan since I was young. Here are some brand lessons we can learn from them.

Learn More